Getting The Guided Wealth Management To Work

Getting The Guided Wealth Management To Work

Blog Article

Some Known Questions About Guided Wealth Management.

Table of ContentsGuided Wealth Management - TruthsRumored Buzz on Guided Wealth ManagementEverything about Guided Wealth ManagementSome Known Incorrect Statements About Guided Wealth Management Guided Wealth Management - The FactsFacts About Guided Wealth Management Revealed

Choosing a reliable economic expert is utmost important. Consultant roles can vary depending on several factors, including the kind of monetary consultant and the customer's demands.A limited advisor ought to declare the nature of the constraint. Offering appropriate strategies by evaluating the history, financial data, and capacities of the customer.

Offering strategic plan to collaborate individual and business finances. Assisting customers to implement the monetary plans. Reviewing the implemented plans' efficiency and upgrading the executed intend on a normal basis regularly in various phases of clients' growth. Regular tracking of the economic profile. Maintain monitoring of the customer's tasks and verify they are adhering to the right path. https://bradcumner4020.wixsite.com/guided-wealth-manage/post/retirement-planning-brisbane-your-comprehensive-guide-to-wealth-management-and-financial-advisory-i.

If any issues are come across by the monitoring advisors, they figure out the source and address them. Build a financial danger evaluation and examine the prospective impact of the danger. After the completion of the threat evaluation version, the adviser will evaluate the results and supply a suitable option that to be applied.

Facts About Guided Wealth Management Revealed

In the majority of nations consultants are employed to conserve time and lower stress and anxiety. They will certainly help in the achievement of the economic and personnel goals. They take the obligation for the offered choice. Consequently, clients require not be concerned about the decision. It is a long-term procedure. They need to research and evaluate more locations to line up the right course.

But this led to a rise in the web returns, cost financial savings, and also led the path to earnings. A number of measures can be contrasted to identify a certified and qualified advisor. Usually, advisors require to meet common scholastic qualifications, experiences and accreditation advised by the government. The standard academic credentials of the advisor is a bachelor's degree.

Constantly make sure that the recommendations you get from a consultant is constantly in your finest rate of interest. Inevitably, financial advisors maximize the success of a business and also make it grow and flourish.

Not known Details About Guided Wealth Management

Whether you require somebody to help you with your tax obligations or stocks, or retirement and estate preparation, or all of the above, you'll locate your response here. Keep checking out to discover what the distinction is between a financial expert vs planner. Basically, any type of professional that can aid you manage your cash in some fashion can be thought about a monetary expert.

If your goal is to produce a program to fulfill long-lasting financial objectives, then you possibly want to enlist the services of a certified economic coordinator. You can look for a coordinator that has a speciality in tax obligations, investments, and retirement or estate preparation.

An economic advisor is simply a broad term to explain a specialist that can help you manage your money. They might broker the sale and purchase of your stocks, take care of investments, and assist you develop an extensive tax obligation or estate strategy. It is essential to keep in mind that an economic expert should hold an AFS license in order to serve the general public.

All About Guided Wealth Management

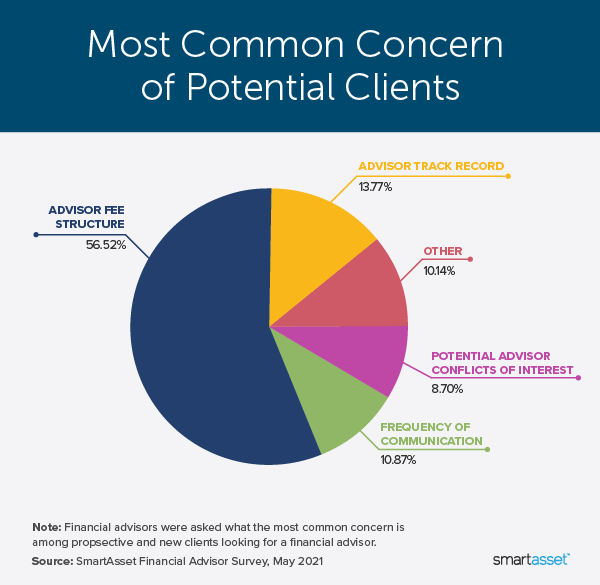

If your monetary advisor checklists their services as fee-only, you must expect a listing of services that they supply with a break down of those fees. These specialists don't use any kind of sales-pitch and typically, the services are reduced and completely dry and to the point. Fee-based experts charge an in advance charge and after that earn payment on the financial products you buy from them.

Do a little research study first to be sure the monetary advisor you employ will certainly be able to deal with you in the long-term. The most effective location to start is to request references from family, close friends, colleagues, and neighbors that are in a similar monetary scenario as you. Do they have a trusted financial consultant and just how do they like them? Asking for recommendations is an excellent means to learn more about a financial consultant before you even meet them so you can have a much better concept of how to handle them up front.

More About Guided Wealth Management

Make your potential advisor respond to these concerns to your complete satisfaction prior to moving onward. You may be looking for a specialized consultant such as someone that focuses on separation or insurance preparation.

An economic consultant will certainly help you with establishing achievable and reasonable objectives for your future. This could be either beginning a business, a family members, preparing for retired life every one of which are essential phases in life that require mindful factor to consider. A financial consultant will certainly take their time to discuss your circumstance, short and lengthy term objectives and make recommendations that are ideal for you and/or your family.

A study from Dalbar (2019 ) has shown that over two decades, while the average investment return has actually been around 9%, the typical investor was only obtaining 5%. And the distinction, that 400 basis factors per year over 20 years, was driven by the timing of the investment choices. Handle your profile Protect your possessions estate planning Retired life intending Handle your incredibly Tax investment and monitoring You will certainly be required to take a threat resistance set of questions to provide your advisor a clearer picture to identify your investment possession allocation and preference.

Your advisor will take a look at whether you are a high, tool or low danger taker and established a possession appropriation that fits your threat resistance and capability based upon the information you have provided. For instance a risky (high return) person might spend in shares and residential property whereas a low-risk (reduced return) person may want to invest in money and term deposits.

Everything about Guided Wealth Management

Consequently, the a lot more you save, you can pick to invest and construct your riches. As soon as you involve a monetary advisor, you don't need to manage your profile (financial advisor north brisbane). This saves you a whole lot of time, effort and power. It is important to have correct insurance coverage which can provide comfort for you and your family members.

Having a monetary advisor can be incredibly useful for many individuals, however it is vital to weigh the pros and disadvantages prior to making a choice. In this article, we will check out the advantages and drawbacks of functioning with an economic advisor to assist you choose if it's the ideal step for you.

Report this page